1. Overview

3. Money

The British economy is based on the Anglo-Saxon model,

focusing on the principles of liberalisation, the free market, and low

taxation and regulation.

The United Kingdom has the 5th largest economy in the

world (2nd in Europe after Germany). The UK, a leading trading power and

financial centre, is one of the quintet of trillion dollar economies of

Western Europe. Over the past two decades the government has greatly reduced

public ownership (since the 1980s, and particularly under the Government of

Margaret Thatcher, many state enterprises that were nationalised in the

1940s have been privatised) and contained the growth of social welfare

programs. Agriculture is intensive, highly mechanized, and efficient

by European standards, producing about 60% of food needs with 1% of

the labor force. The UK has large coal, natural gas, and oil reserves;

primary energy production accounts for 10% of GDP, one of the highest shares

of any industrial nation. Services, particularly banking,

insurance, and business services, account by far for the largest

proportion of GDP while

industry continues to decline in importance

![]() .

Inflation, interest rates, and unemployment remain low

.

Inflation, interest rates, and unemployment remain low

![]() .

However, regarding poverty rates and income inequality

it is one of the weakest

.

However, regarding poverty rates and income inequality

it is one of the weakest

![]() .

.

The relatively good economic performance has complicated the BLAIR

government's efforts to make a case for Britain to join the European

Economic and Monetary Union (EMU). Critics point out that the economy is

doing well outside of EMU, and they cite public opinion polls that continue

to show a majority of Britons opposed to the Euro. Meantime, the government

has been speeding up the improvement of education, transport, and health

services, at a cost in higher taxes and a widening public deficit.

The Government has set five key longterm

economic goals: raising productivity; increasing employment opportunity for

all; providing educational opportunity for all; abolishing child poverty;

and delivering

![]() strong

and dependable public services.

strong

and dependable public services.

Energy:

About 75% of UK electricity is currently generated from fossil fuels (thanks to coal and North Sea oil). Nuclear power and an increasing contribution from dams (hydro-electric power) and wind turbines make up the bulk of the remainder. The UK is the world's 8th greatest producer of carbon emissions. The Government is committed to meeting ambitious targets to reduce UK emissions of greenhouse gases (Kyoto Protocol). Due to the island location, the country has great potential for generating electricity from offshore windfarms, wave power and tidal power. Latest studies suggest that onshore windfarms should be able to supply nearly 5% of the national electricity requirements by 2010.

Industry:

Agriculture and fishing: Agriculture is intensive, highly mechanised, and efficient by European standards, producing about 60% of food needs with only 1% of the labour force. Around two thirds of production is devoted to livestock, one third to arable crops. Agriculture is heavily subsidised by the European Union. The UK is one of the world's leading fishing nations.

Manufacturing: This sector has been continuously declining in the importance since the 1960s, although the sector is still important for overseas trade, accounting for more than 80% of exports. Engineering and allied industries comprise the largest sector in manufacturing. Within this sector, transport equipment is the largest contributor, with 8 global car manufacturers being present in the UK – BMW, Ford, General Motors, Honda, Nissan, PSA, Toyota and Volkswagen. Associated with this sector are the aerospace and defence equipment industries. Another important component of Engineering and allied industries is electronics, audio and optical equipment. Chemicals and Chemical-based products are another important contributor to the UK's manufacturing base. Within this sector, the pharmaceutical industry is particularly successful, with the world's second and third largest pharmaceutical firms (GlaxoSmithKline and AstraZeneca respectively) being based in the UK and having major research and development and manufacturing facilities there. Other important sectors of the manufacturing industry include Food (Unilever, Cadbury), Drink (Schweppes), Tobacco (British American Tobacco), Paper, Printing, Publishing (Reed Elsevier) and Textiles (Umbro).

Services: The service sector is the dominant sector of the UK economy, normally a sign of an advanced economy.

Financial services: London is the world's largest financial centre having 500 banks with offices in the City and Docklands (both are district of London), with the majority of business being conducted on an international basis. Edinburgh also has a long established financial industry. It is the fifth largest financial centre in Europe.

Tourism is the 6th largest industry in the UK.

Top UK Companies by Market Capitalisation*:

|

Rank |

Company |

Business sector |

Market capitalisation (£ million) |

|

1 |

Vodafone |

telecommunications |

154,684 |

|

2 |

BP |

oil and gas |

121,205 |

|

3 |

GlaxoSmithKline |

pharmaceuticals |

109,221 |

|

4 |

HSBC |

retail banking |

95,798 |

|

5 |

AstraZeneca |

pharmaceuticals |

56,335 |

|

6 |

Shell Transport & Trading |

oil and gas |

54,540 |

|

17 |

Tesco |

food & drug retailers |

17,771 |

*Market capitalization refers to the aggregate value of a firm's outstanding common shares.

It reflects the total value of a firm's equity currently available on the market.

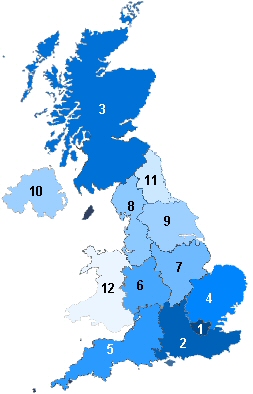

The strength of the UK economy varies from region to region. The following table shows the GDP (2002) per capita of the 12 regions of Britain. Generally people on the South earn the most money and going North and West the salaries are decreasing (except for Scotland): The average salary in London is two times more than in Wales or in Northern Ireland.

|

Rank |

Place |

GDP per capita |

|---|---|---|

|

1 |

London |

170 |

|

2 |

South East |

115 |

|

3 |

Scotland |

101 |

|

4 |

East of England |

99 |

|

5 |

South West |

98 |

|

6 |

West Midlands |

94 |

|

7 |

East Midlands |

93 |

|

8 |

North West |

93 |

|

9 |

Yorkshire and the Humber |

93 |

|

10 |

Northern Ireland |

83 |

|

11 |

North East |

82 |

|

12 |

Wales |

81 |

|

GDP: |

£1,066 trillion (12 times that of Hungary) (2005 est.) |

|

GDP - real growth rate: |

1.8% ( |

|

GDP - per capita: |

£17,650 (2 times that of Hungary) (2005 est.) |

|

agriculture: 1.1% ( |

|

|

Inflation rate (consumer prices): |

2.2% ( |

|

Values for two of the main economic indicators since 1975:

|

|

|

Labor force - by occupation: |

agriculture 1.5% (

industry 19.1% (

services 79.5% ( |

|

4.7% ( |

|

|

17% ( |

|

|

Budget: |

revenues:

£503 billion |

|

|

|

|

Agriculture - products: |

cereals, oilseed, potatoes, vegetables; cattle, sheep, poultry; fish |

|

Industries: |

machine tools, electric power equipment, automation equipment, railroad equipment, shipbuilding, aircraft, motor vehicles and parts, electronics and communications equipment, metals, chemicals, coal, petroleum, paper and paper products, food processing, textiles, clothing, and other consumer goods |

|

Exports-Imports: |

Despite having only one per cent of the world’s population, Britain is the fifth largest trading nation in the world. The chemical industry is Britain’s largest export earner, and the third largest in Western Europe. Since the 1970s, oil has contributed significantly to Britain’s overseas trade, both in exports and a reduced need to import oil. British Petroleum (BP) is Britain’s biggest and Europe’s second biggest industrial company. UK pharmaceutical companies make three of the world’s best selling medicines: ‘Zantac’ (made by Glaxo Wellcome) for ulcer treatment; ‘Tenormin’ (ICI), a beta-blocker for high blood pressure; and ‘AZT’ (Glaxo Wellcome), a drug used in the treatment of AIDs. Britain is also a major supplier of machinery, vehicles, aerospace products, electrical and electronic equipment. Britain is responsible for 10 per cent of the world’s export of services, including banking, insurance, stockbroking, consultancy and computer programming. Britain imports six times as many manufactures as basic materials. EU countries account for seven of the 10 leading suppliers of goods to Britain and Germany is Britain’s biggest supplier of imports. Food, beverages and tobacco account for half of non-manufactured imports, while machinery and road vehicles account for two-thirds of finished imported manufactures. Other major imports include chemicals, fuels, clothing and footwear. |

|

Exports: |

£213 billion (2005 est.) 6th in the world |

|

Exports - partners: |

US 15.3%, Germany 10.8%, France 9.2%, Ireland 6.8%, Netherlands 6%, Belgium 5.1%, Spain 4.5%, Italy 4.2% (2004) |

|

Imports: |

£276 billion (2005 est.) 4th in the world |

|

Imports - partners: |

Germany 13%, US 9.3%, France 7.4%, Netherlands 6.6%, Belgium 4.9%, China 4.3%, Italy 4.3% (2004) |

The cost of living such us wages varies from one part of the UK to another. Generally it is more expensive to live in London and the south-east of England, and cheaper up north. Below is a rough estimate of how much things cost in the UK in 2005.

1£ = 383 Ft (May, 2006)

|

England |

Scotland |

Wales |

N. Ireland |

|

|

gross monthly earnings, £ |

1680 ~640,000 HUF |

1560 ~600,000 HUF |

1530 ~585,000 HUF |

1490 ~570,000 HUF |

The average salary in the UK is 3.7 times more than in Hungary, while the prices of the basic items one needs for living are never 4 times as much...

1£ = 383 Ft (May, 2006)

Item |

Cost in England (pounds, £) |

Cost in N. Ireland (pounds, £) |

Milk (4 pints) |

1.11 (~190 HUF/litre) |

0.99 |

Apple Juice (1 litre) |

0.83 (~320 HUF) |

0.65 |

Bread (400g loaf) * |

0.45 (~430 HUF/kg) |

0.35 |

Eggs (carton of 6) |

0.98 (~375 HUF) |

0.45 |

Sugar (750g) |

0.79 (~400 HUF/kg) |

0.80 |

Butter Spread (250g) |

0.82 (~315 HUF) |

0.75 |

Raspberry Jam (454g) |

0.75 (~287 HUF/500g) |

0.70 |

Newspapers |

0.50 (~190 HUF) |

0.35 |

Inexpensive restaurant |

12£/person (~4,600 HUF) |

7.00 |

Petrol (gasoline, 1 litre) |

0.94 (~360 HUF) |

0.96 |

Shampoo (200ml) |

1.67 (~640 HUF) |

1.95 |

Toothpaste (100ml) |

1.87 (~715 HUF) |

0.99 |

Kit Kat chocolate bar |

0.45 (~170 HUF) |

0.49 |

Can of pepsi |

0.60 (~230 HUF) |

0.65 |

McDonalds Meal |

3.50 (~1,350 HUF) |

3.15 |

Fish and chips |

5.00 (~1,910 HUF) |

4.20 |

Theatre Ticket |

20.00 (~7,600 HUF) |

18.00 |

Cinema Ticket |

7.50 (~2,850 HUF) |

5.00 |

* This is a very good quality bread, not 'TESCO gazdaságos'!

The Currency of the UK is the pound sterling. The sign and abbreviation for the pound are £ and GBP = Great British Pound respectively. The Euro is not in use. Although a few of the big shops will accept Euro, it is rarely used across Britain. The pound (£) is made up of 100 pence (p). The singular of pence is "penny". An amount such as 50p is often pronounced "fifty pee" rather than "fifty pence". Coins and banknotes both are in use:

Coins

All the coins bear Her Majesty The Queen's head on one side. On the edge of coins, the letters D.G.REG.F.D. always appear after the Queen's name. The letters stand for the Latin words Dei Gratia Regina Fidei Defensor, which means 'By the Grace of God, Queen, Defender of the Faith'.

|

1 pence (a penny). copper |

|

A two-pence piece can be referred

to as tuppence (often used as synonimous of nothing or tiny)

or a tupenny. copper |

|

This coin shows the symbol of Scotland, the thistle.

silver |

|

The 10 pence coin (about the size of a US Quarter)

shows a lion. silver |

|

The 20 pence coin shows the Tudor Rose. silver |

|

The 50 pence coin shows the picture of Britannia and a

lion. silver |

|

There are many different pictures on the £1 coin to reflect the different countries of Britain: lions for England, a thistle for Scotland and a leek for Wales. The coin on the left shows the three lions of England. The slang term for pound is quid. gold! |

|

The design of the 2 pound coin represents technological development. The edge lettering features the quote "Standing on the Shoulders of Giants" by Sir Isaac Newton. gold and silver |

Banknotes

There are eight banks authorised to issue banknotes in the UK.

1. England and Wales - Bank of England notes:

|

|

The £5 note features Elizabeth Fry, who made her name fighting for improved living conditions for women in European jails. |

|

|

The £10 note features Charles Darwin, the Victorian naturalist who developed the theory of evolution. |

|

|

The £20 note features Sir Edward Elgar, a composer whose orchestral works include Enigma Variations (1896) among others. |

|

|

The £50 note features Sir John Houblon, the first governor of the Bank of England. |

These are legal tender in England and Wales, and generally accepted throughout the UK. Each denomination has a different size and colour. All banknotes bear HM The Queen's head on one side and a famous historical person on the other side. Queen Elizabeth ll is the first monarch to have her portrait printed on a banknote. It was first done in 1960 as a way of helping to prevent forgeries. There are two banknotes with other names: the "Fiver" (£5) or the "Tenner" (£10).

2. Scotland - Bank of Scotland notes: There are different versions of Scottish banknotes (issued by different banks in Sc.)

All the notes depict Sir

Walter Scott who was instrumental in retaining the right of Scottish banks to issue their own notes in the 1840s. The designs on the back of the notes reflect various aspects of Scottish

industry and society. The themes have been carefully selected, and all are of

particular resonance:

All the notes depict Sir

Walter Scott who was instrumental in retaining the right of Scottish banks to issue their own notes in the 1840s. The designs on the back of the notes reflect various aspects of Scottish

industry and society. The themes have been carefully selected, and all are of

particular resonance:

|

|

£5 represents the oil and energy industry, so crucial to the Scottish economy from the 1970s. |

|

|

£10 depicts the distilling and brewing sector, which some would argue to be the very essence of Scotland! |

|

|

£20 pays tribute to Scotland's major achievements and contributions to the fields of education and research. |

|

|

£50 celebrates the vibrancy and rich diversity of

Scottish arts and culture. |

|

|

£100 features tourism, one of the biggest employers in the Scottish service sector. |

3. Scotland - Royal Bank of Scotland notes:

All the notes (£1, £5, £10, £20, £50, £100) depict Lord Ilay, the first governor of the bank on the obverse and castles of Scotland on the reverse.

4. Scotland - Clydesdale Bank notes:

|

|

The £5 note features Robert Burns, Scottish poet and writer of traditional Scottish folk songs. |

|

|

The £10 note features Mary Slessor, Scottish missionary in Nigeria. |

|

|

The £20 note features Robert the Bruce, Scotland's most celebrated king; won a treaty recognizing Scotland’s independence. |

|

|

The £50 note features Adam Smith, Scottish philosopher and economist. |

|

|

The £100 note features Lord Kelvin, one of the most respected physical scientists of the 19th century. |

Scottish banknotes are unusual in that they are not legal tender anywhere in the UK - not even in Scotland - they are in fact promissory notes. Indeed, no banknotes (even Bank of England notes) are now legal tender in Scotland - although like debit cards and credit cards, they are still used as money.

5. Northern Ireland - Bank of Ireland notes:

All Bank of Ireland notes feature the Queen's University of Belfast on the obverse. The principal difference between the denominations is their colour and size.

6. Northern Ireland - First Trust Bank notes:

First Trust Bank's current notes depict generic people of Northern Ireland on the front, alternately male and female, but with a pair of older people on the £100 note. The obverse generally features designs associated with the Spanish Armada, or coastal features.

7. Northern Ireland - Northern Bank notes:

First Trust Bank's current notes depict generic people of Northern Ireland on the front, alternately male and female, but with a pair of older people on the £100 note. The obverse generally features designs associated with the Spanish Armada, or coastal features.

The £5 note features U.S. space shuttle.

The £10 note features J. B. Dunlop, the inventor of the pneumatic tire.

The £20 note features Harry Ferguson, engineer & inventor; made the 1st powered flight in Ireland; invented the modern tractor.

The £50 note features Sir S.C. Davidson.

The £100 note features Sir James Martin, engineer & inventor of the ejector seat.

8. Northern Ireland - Ulster Bank notes:

Ulster Bank's current notes all share a rather plain design of a view of Belfast harbour flanked by landscape views; the design of the reverse is dominated by the bank's coats-of-arms. The principal difference between the denominations is their colour and size.

These banknotes are rarely seen outside Northern Ireland. They are generally accepted in Scotland, but are often not accepted in England and Wales without some explanation.

|

shares |

részvény |

|

equity |

tőke |

|

portcullis |

kapurostély |

|

legal tender |

hivatalos fizető eszköz |

|

denomination |

címlet |

sources:

National Statistics, UK 2002, The Official Yearbook of Great Britain and Northern Ireland

Wikipedia, Economy of the United Kingdom

learn more:

credits:

Overview: Extracted from Wikipedia The Free Encyclopedia under GNU Free Documentation Licence.